Comments off

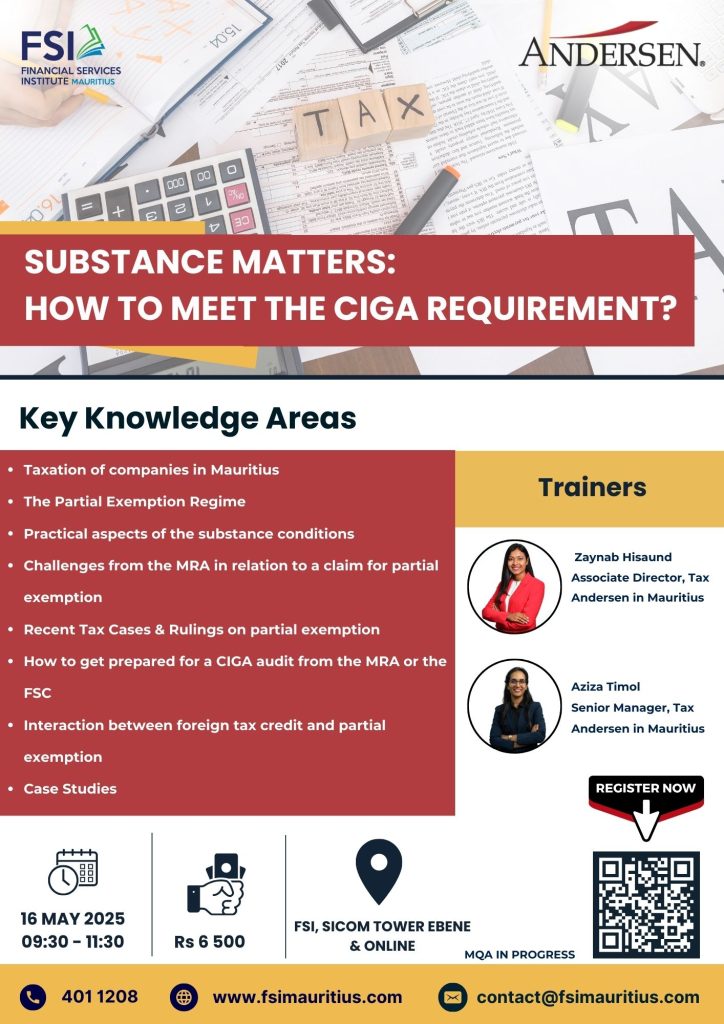

Substance Matters: How to meet the CIGA requirement?

Queries: +230 4011208 / registrations@fsimauritius.com

Content

- Taxation of companies in Mauritius

- The Partial Exemption Regime

- Practical aspects of the substance conditions

- Challenges from the MRA in relation to a claim for partial exemption

- Recent Tax Cases & Rulings on partial exemption

- How to get prepared for a CIGA audit from the MRA or the FSC

- Interaction between foreign tax credit and partial exemption

- Case studies

Trainers

Zaynab Hisaund

Associate Director, Tax

Andersen in Mauritius

Aziza Timol

Senior Manager, Tax

Andersen in Mauritius

An Initiative of the Ministry of Financial Services and Good Governance